Sistema de Lavado ECOlógico

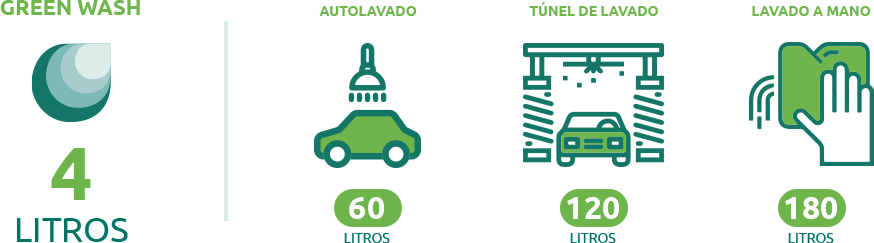

En nuestro centro de lavado ecológico nos preocupa tanto tu vehículo como el medio ambiente. Por eso utilizamos un exclusivo sistema de limpieza ecológica patentado que sólo requiere cuatro litros de agua por vehículo.

Servicios

Nuestro sistema de limpieza ecológica nos permite ofrecerte una amplia gama de servicios de lavado, aspirado, desodorización y tratamiento de la tapicería, a cargo de operarios especializados.

La oferta de servicios de lavado ecológico de vehículos en Plaza de las Cortes, en Madrid, más amplia del mercado.

Todos los servicios los realizan a mano operarios especializados. Ahorramos agua y usamos productos de limpieza 100 % biodegradables.

Limpieza Integral

Tu vehículo impecable, por dentro y por fuera, para que lo vuelvas a disfrutar como si fuera nuevo. Si hace tiempo que no lavas tu coche o tienes algún compromiso en el que debas ofrecer la mejor imagen: una boda, un viaje, llevar a tu jefe al aeropuerto… ¡No te arriesgues a dar una mala impresión!

LavadoEcológico

Lavado interior y exterior de tu vehículo totalmente a mano, mediante un sistema ecológico patentado que utiliza solamente 4 litros de agua y productos biodegradables adecuados.

Desodorización

Sistema de limpieza con ozono innovador que elimina los malos olores de tabaco, comida, etc. Además, limpiamos y desinfectamos las canalizaciones de aire, que con el tiempo acumulan polvo, suciedad y gérmenes.

Limpieza de Tapicerías

Disponemos de los productos más avanzados para eliminar las manchas en la tapicería de tu vehículo. Limpiamos toda clase de suciedad en cualquier tipo de tejido. El interior de tu vehículo volverá a lucir como nuevo.

Hidratación de Cuero

En nuestro centro de lavado ecológico empleamos un sistema de hidratación que prolonga la vida del cuero y asegura que su estado será siempre impecable, además de elegante. Previniendo el agrietamiento y decoloración.